Changing spending habits during COVID 19

Do more with less – Agile Insight platforms by QuMind

By centralising all your insight tools, QuMind enables you to drive time and cost efficiencies through your organisation whilst taking back control of your insights. Our toolkit empowers you to make faster agile decisions in an ever changing business environment. Put your customer at the heart of your organisation with the QuMind agile insight toolkit.

Our platform is AI powered with integrated Quant & Qual tools enabling you to collect data across methodologies in one place. It boasts self-serve data collection surveys, pop-up communities, online Qual (diaries/focus groups), pop-up community, dashboards and reporting analysis tools. Text and video analytics ensure you get quick insights from your insight studies.

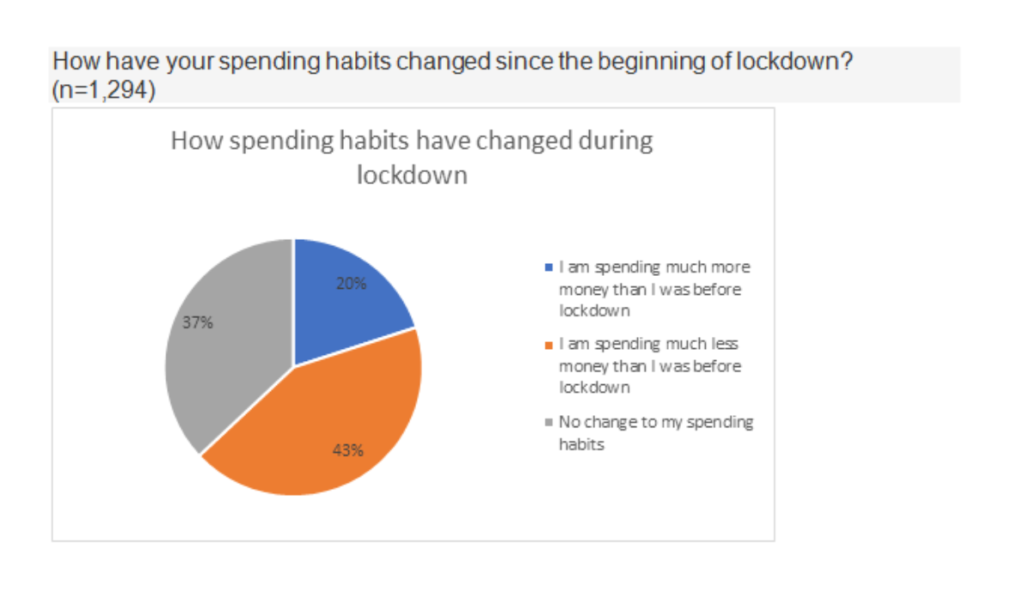

How have spending habits changed?

This week, QuMind panels wanted to find out how spending habits have changed during lockdown. 2 in 5 of us are reportedly spending less money than before lockdown and 1 in 5 spending more.

What are higher spenders doing?

Those who report spending more are often doing so on everyday essential such as energy costs and grocery shopping. There is a perception that grocery shopping is more costly because there are fewer offers in store and reduced ranges:

“Supermarkets have less choice, fewer offers and you seem to have to buy things like veg in packs whether you want to or not and throw away the excess and the packaging.”

Premium grocery spending up

There is willingness to spend more on some premium grocery items as a way to replace treats, such as eating out or take away:

“I’ve been spending a little bit more on food at home to make up for not being able to get takeaways (due to being vulnerable and not wanting potentially infected packaging in the house).”

Non-essential spending remains limited but DIY improvements are the exception to the rule

Spending on non-essential items is still often limited. However, we do still see reported increased spending on home improvements with people re-decorating, buying new furniture or revamping the garden:

“I thought that, with not leaving the house much, I would be spending less but actually I am still spending only now it is on different things. I have spent nothing on clothing or shoes, make-up and nails, but have spent more on food as needing to shop closer to home where the shops are more expensive and since travelling to larger supermarkets I have noticed rising prices. I have also bought some French furniture paint and painted all my hall things blue”

What are lower spenders doing?

Lowers spenders often see the largest saving come from reduced transport, travel and leisure costs (even as things start to open backup).

There can be a sense of disbelief at how much money was being spent before, and a desire to hold on to any savings made going forward:

“I always found it difficult to save as my bills and lifestyle seem to use up most of my income, but strangely since lockdown when I haven’t gone out for meals, down the pub, been shopping in town or had days out then I have managed to save. I hadn’t realised just how much I spend on such things until I couldn’t!”

Spending will continue to change

Spending habits have changed and will continue to do so in the coming weeks and months, we will revisit this topic again in several weeks to see whether the mood towards spending has softened.

Want to take back control of your research, doing even more with less? Get in touch with [email protected].