Consumer trends: UK – When will we start travelling again?

The impact of uncertainty on the UK traveller

There have been many changes to holiday plans this year, including the countless examples of cancelled flights this summer. However, despite some easing of travel restrictions, there is still uncertainty around travelling this year.

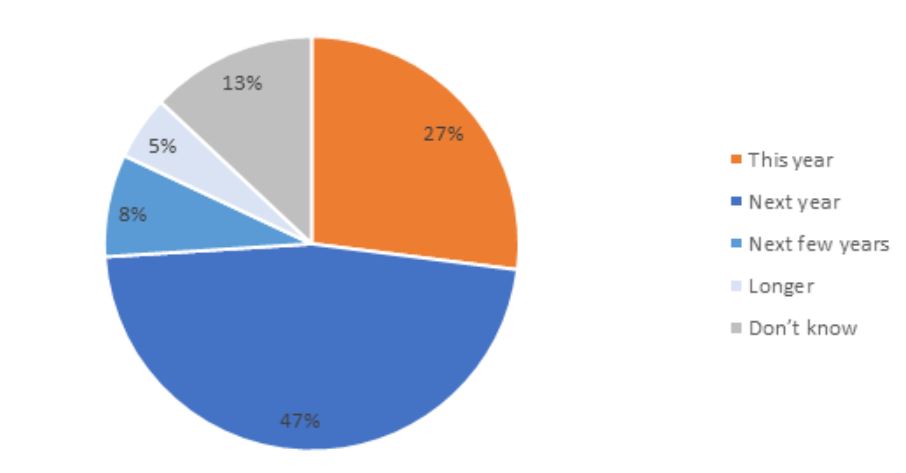

Almost half of our UK panellists say that the earliest they will consider travelling again is next year, and a further 13% in the next few years or longer. On the other hand, close to 30%, will still consider travelling this year. There is a strong hope that by next year, the virus will be contained (with some expectation for a vaccine) and far fewer restrictions.

QuMind online panel covers 65+ markets and 100M+ respondents worldwide. Our platform is automated which in turn drives cost savings which we pass on directly to our customers. The average cost per complete offered by QuMind is often 10-15% below the market average. We enable you to self-serve online sample via our powerful integrated toolkit.

Consumer concerns vary

The primary fear right now is still the risk associated with catching or passing the virus on to others, as well as other concerns around the comfort and logistics of travelling while there are so many rules in place (e.g. wearing masks, longer queues, need to socially distance):

“…My concerns for booking are mainly around mattresses, pillows, towels, food, distancing, queues, rules/ regs whilst we are out and about including their public transport system, language barriers, places being closed like hotel pool or having to book weeks in advance for popular places…”

“…Multiple worries! I’m not excited by the prospect of over 2 hours on a plane, packed in with others sharing recirculating air (models seem to show air con is a high-risk spreader within enclosed spaces). Presumably by then we will need to wear masks both inside the airports and inside the plane so probably four hours in a mask – I find 15 minutes inside M&S shopping quite stifling so 3-4 hours will be hideous. It will be masks everywhere else too while on holiday…”

When will the UK start to travel again – COVID 19. N = 1511 base, UK sample.

Consumers want greater controls to combat COVID 19 while travelling

Regardless of when people will choose to travel, evidence points to a greater need for control when they do, including changing the way they would typically holiday. Having control over lodgings for example is a consideration, whether in the UK or abroad with a preference for self-catering options that allow for easier social distancing and give control over cleaning and food options:

“…Normally we stay at hotels but are considering self-catering this time as we think this might be safer. would be in more control of keeping the place clean (assuming that it was super clean at the start of the break and safe), more relaxed doing our own cooking etc. so that we could maintain better social distancing…”

“…We have booked Airbnb with assurances from the owners of strict hygiene measures and sanitation and use of bedding and towels which will be boiled between guests. We will as well carry out our own sanitation when we get there just to make sure so we feel in control of the situation and we will take all our own food with us and not eat out unless the level of cases has dropped drastically by September and then we may feel less worried…”

Staycation here to stay?

Those opting for a staycation, seek comfort; from not having to board a plane or use public transport opting for using a car instead and travelling to a destination close to home, limiting therefore also exposure to others.

Regardless of how things play out from here, caution due to the virus is likely to stay with us for a good while. Brands in the travel sector, and beyond, will need to acknowledge and adapt to offer prospective customers a sense of control and greater comfort to help overcome their concerns.

Want to get in on the action? Track how your consumers are feeling – get in touch with [email protected].

QuMind is your solution to an agile market research platform with AI and integrated Quant & Qual tools. It boasts self-serve data collection surveys, pop-up communities, online Qual (diaries/focus groups), pop-up community, dashboards and reporting analysis tools.